August was a typically quiet month for equity markets, with the FTSE largely treading water and half-year earnings season coming to a close.

The FTSE 100 can find few friends at the moment, with the Index being the worst performing global market in 2020, down 20.9%.

To be honest, much of this underperformance is deserved - the FTSE 100 is heavy on old-world price takers, such as oil and gas majors, banks and miners, and lacking in genuinely innovative businesses, such as tech and healthcare names, which are already the great winners of the 21st century. Thankfully, we are in the lucky situation with our UK Equity Growth Fund that we have no requirement to own these crumbling UK giants and can, instead, cherry-pick the best of British with the addition of up to 20% in international businesses on top of this.

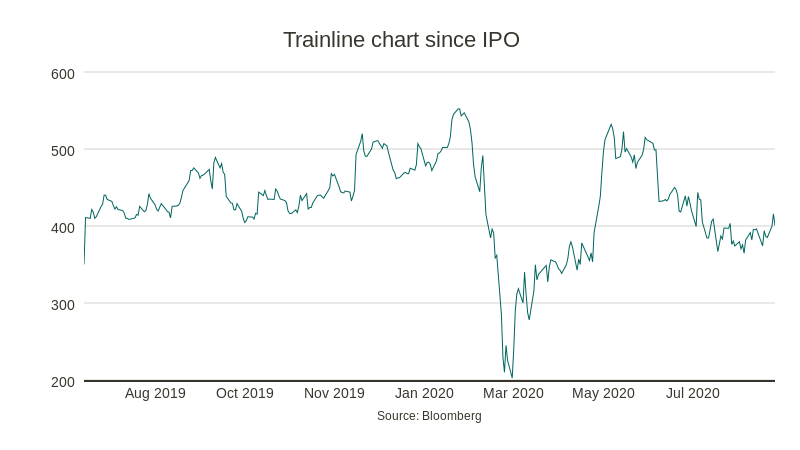

One such UK business that we are excited to be investors in is Trainline, the ticketing platform that we hope you are loyal users of. We believe that Trainline could double its earnings over the next few years without needing to break a sweat and that is before expansion into Europe and Japan has been factored-in. Currently, only 40% of UK train tickets are booked online and, particularly strangely, almost all season tickets are still used in paper form. The shift to digital ticketing was already moving at pace pre-COVID (remember then?), but this has shifted up a gear in 2020 as buying and using a ticket from your mobile is clearly more hygienic than buying paper tickets from a kiosk. Trainline shares have had a volatile ride since IPO in June 2019 (see chart, right) and we initiated our investment in March 2020 and further added to the position in August. Short-term, reduced passenger numbers will clearly be a headwind for Trainline (they make money by earning 5% commission on all ticket sales via their platform), but long-term, the move to e-ticketing strikes us as a clear structural growth story and we are confident that people will take the train again – we cannot tell you exactly when that will be, but we are happy to wait patiently.

We also took the opportunity of recent share price weakness in old friends Diageo and RELX to further add to these top five positions in the Fund. We have been investors in both businesses for over 20 years and hope to remain so for many more.

How would you like to share this?