July was a dismal month for the UK markets (especially in comparison to their US peers). The FTSE 100 was down 4.4% and the FTSE Higher yield down 7.2%.

Thankfully, our Fund continued to show resilience in trickier markets, down 1.3% in the month. London suffered from the dominance of a few large companies in struggling industries and this was underscored by poor results from a number of them, including Lloyds, RBS and Royal Dutch Shell – none of whom are in the Fund.

We had a busy month, adding to many recently established positions and trimming profits. Rio Tinto (and the London miners in general) have had a rip-roaring rally since the March lows and had rallied 67% into July as we decided to reduce the position as it approached £50. Using the profits, we added to Relx, Halma and Clinigen, to name just a few.

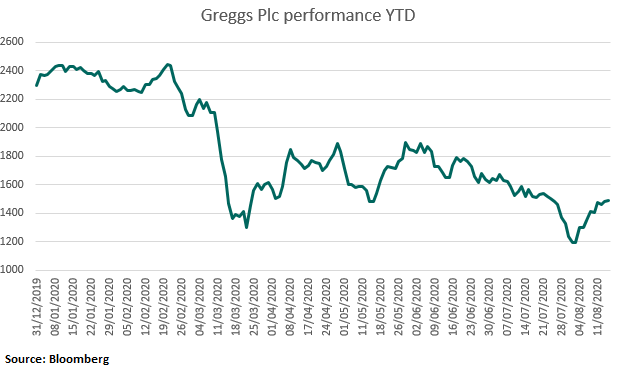

The main activity in the portfolio was increasing our position in Greggs at the end of the month, and initiating a new position in small-cap Porvair.

Greggs had a pretty torrid second quarter as almost their entire retail estate was closed during the pandemic and they shelved plans for their interim dividend. However, it is a business we have followed for a long time and admire. We initiated in the delicious baked goods retailer in June and added further as the price drifted back down at the end of July, and see this as a great opportunity to invest in a proven long-term winner at a reasonable price.

We also initiated in the specialist filtration developer and manufacturer Porvair. This is a lovely small business with lots of inside ownership and a strong management team, who set themselves the target of being like a Halma, Diploma or Spirax-Sarco, which strikes as us a great target to aim for! Industrial, Auto and Aero are 80% of group profitability so no doubt they will have a tough few reporting periods ahead but, long-term, we believe that the business is still facing attractive end-markets and that this is a ripe time to be initiating a position, which was confirmed by an excellent Zoom meeting with management.

How would you like to share this?