Having got off to a good start, 2023 then became a tussle with rates being pushed sharply higher through February then all the way back down over the past couple of weeks.

Probably best illustrated by the US ten-year Treasury yield, which sank to 3.35% in mid-January as markets dared to believe that the end was in sight for Federal Reserve tightening but then shot up to a peak over 4% at the beginning of March as sticky inflation and strong employment figures told a different story. Into March and rates began to wobble again before sinking right back to the lows of January as the woes of the, little known, Silicon Valley Bank (SVB) unfolded.

A few things do stand out about the demise of SVB. It was a classic run on a bank, but now it happens so quickly, thanks to WhatsApp and other media, that there was no dreadful queue of depositors to be filmed (Northern Rock was probably the last of those). It was also a classic case of ‘borrowing short and lending long’ – how very old-fashioned. They were funding with (v mobile) wholesale deposits and investing in dated US Treasuries, which sank with the jump in bond yields over the past year. It appears that the mounting losses on the bond book were not ‘marked-to-market’ (the losses had not been realised see!). It is more than a little surprising that the US regulators were not monitoring this.

Late last year, Jerome Powell, Chairman of the US Federal Reserve, said that he wanted to “bring some pain”, before raising rates twice more. He has achieved his objective in the bank sector, which, in itself, will serve to tighten credit conditions further. All eyes now turn to the Federal Reserve meeting this week, expectations have ranged widely, having been out to a three-quarter point increase last month, they are now for a quarter-point move at worst.

Markets quickly moved on to hunting out other potential weak spots amongst similar US regional banks and the focus at present is on First Republic Bank. The major US banks are probably benefitting from all of this as they are soaking up the deposits leaving the regionals and, of course, they have much tougher rules to follow.

The share prices of banks everywhere have suffered over the past ten days as the hunt for further problems widened. The focus swiftly turned to Credit Suisse, a bank that has been struggling with a series of problems over the past few years, remember Archegos Capital Management, and whose share price has been falling for a long time. As has been widely reported, the Swiss authorities orchestrated the takeover of Credit Suisse by UBS Group over this past weekend, while providing huge support in the process. This is welcome but does bring with it some ‘interesting’ issues.

As part of the takeover process, Credit Suisse’s lowest tier of debt, their Additional Tier 1 bonds, have been declared worthless. The Swiss central bank and regulators were extremely keen to avoid any impression of bankers being ‘bailed-out’, as has also been the case in America with SVB, where it is clear that the Federal Reserve and Biden administration are also seeking to avoid being tarred with this particular brush. Additional Tier 1 bonds (and contingent convertibles, CoCos), were introduced after the 2008/9 financial crisis as a new lowest form of debt, which could be converted to equity or written off if a bank’s capital fell below a prescribed level. This has grown to become a big market as investors were drawn to the higher coupons on offer from these bonds, possibly not taking enough notice of the big risk lurking in the background (a large written put option to my mind).

But the Swiss regulators have set an uncomfortable precedent here (doubtless backed by legal opinion), the Additional Tier 1 bonds have been declared worthless while the equity holders retain some value (UBS shares). This will create problems across the sector and the initial cautious response from markets is understandable. It would seem to be a case of the strong getting stronger (possibly not that attractive politically) and it certainly does look as if there are great opportunities to be found amongst the major banks on both sides of the Atlantic. We do feel that these problems are quite specific to a small number of banks and that this is not a systemic risk for the bank sector as a whole but, doubtless, this will not be plain sailing.

If there is a silver lining it must be that these problems will certainly act to tighten credit conditions, doing part of the central banks’ job for them, and the raising of rates will, surely, be on hold while this pans out.

Just to be clear, Tenax does not hold any Additional Tier 1 issues or CoCos (from Credit Suisse or anybody else) and never has done. It is not a risk profile to attract us at all.

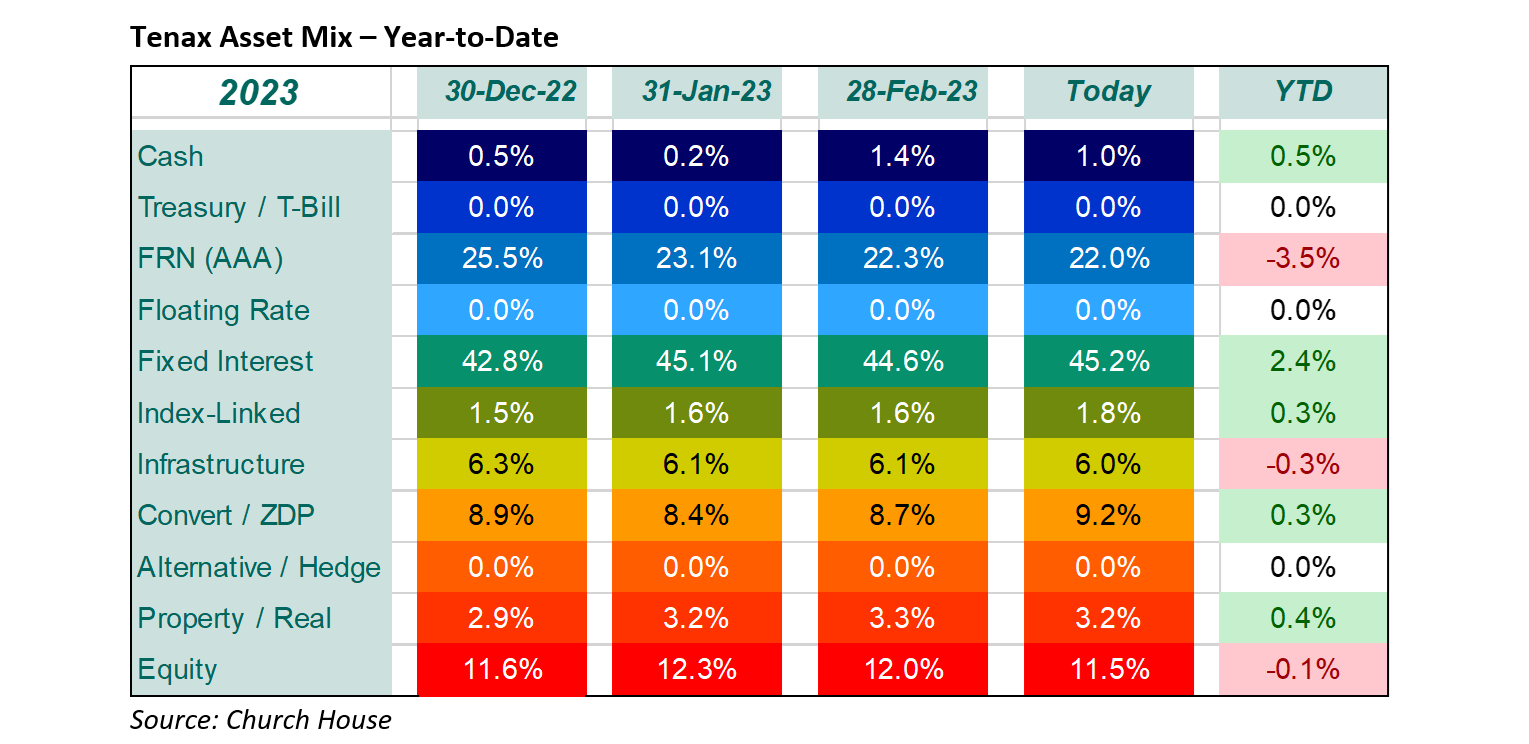

This is supposed to be a piece reporting on activity in the Tenax Fund over the past few weeks, but events seemed to demand rather more by way of explanation. The changing asset mix within the Fund is shown on the right as usual.

The overall pattern of changes is similar to the end of last year with a gradual reduction in floating rate notes and shift to fixed interest following the much more attractive returns now on offer. We still prefer the short-dated end of the fixed interest market, not seeing adequate compensation for the higher risk in longer dated instruments. We have also added to the convertible area and recently begun to re-establish some commodity exposure via Freeport-McMoRan (in the Property / Real area). Our holdings in UK bank equities have suffered over the past couple of weeks but now look to be seriously over-sold, we have also established a small initial position in Morgan Stanley.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?