2023 has commenced in better form with stock markets rising, most notably the hard-pressed NASDAQ, bond yields edging lower and credit spreads narrowing. The US dollar has resumed its decline from the heady levels of autumn last year taking sterling back to the top of its recent range.

The reason, of course, is some further improvement in the inflation figures in the US and Europe, leading to talk that central banks might be able to slow the pace of rate hikes over the first quarter. UK ten-year interest rates have settled back to trade around 3.35%, we still expect the Bank to raise the Base Rate again at their next meeting from the current 3.5%, but with the housing market showing signs of severe stress the question is how much further can they go?

The effect on a number of NASDAQ stocks has been quite dramatic, particularly as they went into the year end in a bearish mood. Alphabet and Amazon.com have both jumped around 10% while Meta and Netflix have gained more. But it’s not just tech, the financials have also shown strong gains, notably the banks where Standard Chartered stood out with a 13% gain after First Abu Dhabi Bank revealed that it had considered making an offer. Easing off were last year’s more defensive sectors like the consumer staples and pharmaceutical companies.

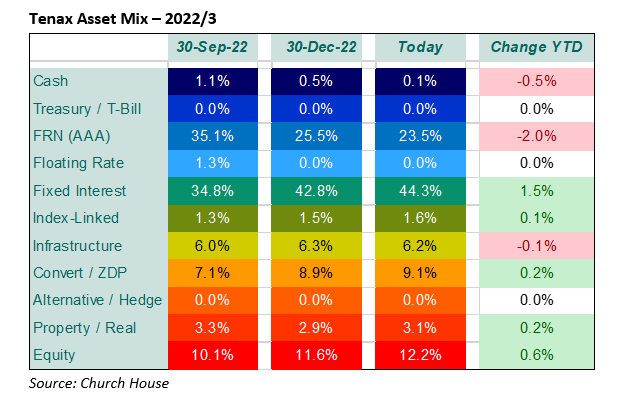

With the Christmas and New Year holidays intervening it has been a quieter period for activity in the Tenax Fund though the pattern of the transactions remains the same. Over the first three weeks of the New Year we have switched further from floating to fixed rate securities to take advantage of the higher returns on offer, right (we have left in the figures for September for comparison).

The credit markets have got off to a flying start with an abundance of new issues coming to market, we have acquired two new higher coupon (investment grade) issues, one from Barclays and one from Royal Bank of Canada. As we have mentioned before, while the yield on our floating rate notes is now over 4%, the opportunity to ‘fix’ these high coupon returns is very attractive for the Fund.

Elsewhere, we have increased the weighting in Property / Real again (though this exposure is higher than immediately apparent as three of our convertibles are property related issues). We reduced the holding in Land Securities, which has now recovered 45% (!) from the autumn lows, in favour of adding more to SEGRO, which has gained a mere 15% since then.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?