We expect UK inflation to continue to moderate as we head into the summer and that this will allow the Bank of England to begin a reduction in the Base Rate, probably in June.

Interest rates for longer periods have fallen since last October while the Base Rate has remained unchanged. This has left short-term interest rates looking attractive, while the medium and longer-dated areas have little to offer and could easily turn volatile again.

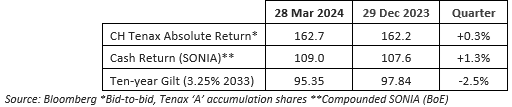

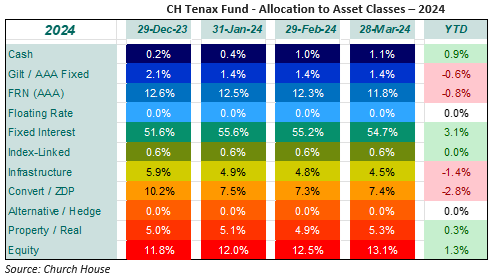

This view is reflected in the Tenax portfolio’s asset mix. Fixed interest assets are the largest portion of the portfolio, but these are focused at the short-dated end (see below, current overall duration* is just 3.2), where we can see attractive returns/opportunities. This table shows the change in asset split over the year to date, right.

The pattern is similar to last year with a further reduction in exposure to floating rate notes (FRN) and an increase in the fixed interest element. To labour the point somewhat we consider that it is time for a switch from floating to fixed rate investments after the massive increase in short rates over the past two years and our expectation that the next move from the Bank of England will be to reduce the Base Rate. The reduction in exposure to convertibles reflects some of these investments getting close to their maturity dates, not an active move away from the area.

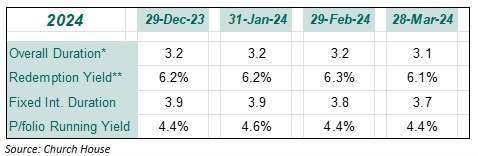

This bottom table, right, shows the duration* and redemption yield** figures for the FRN and Fixed Interest portions, which account for 68% of the portfolio at present, as they have developed over the year. Just to elaborate on that duration figure a bit more, the average time to maturity of this portfolio of bonds (fixed interest securities) is 5 years, the duration of 3.1 reflects the high coupon (interest) stream that the Tenax portfolio will be receiving in the meantime.

Amongst the convertible issues, we have now completed the sale of Primary Health Properties convertible bonds as they mature next year and no longer offer such a good return. However, we have utilised the money to add to our holding in their equity, which does look attractive on a discount to high quality primary healthcare property assets and a high dividend yield.

We took an attractive new issue of bonds from the Coventry Building Society paying a coupon of 5.875% and maturing in 2030, which we funded with a small reduction in our NatWest bond exposure, along with some of our floating rate notes from TSB Bank. The equity holdings have produced positive returns, notably the international holdings and the banks. Infrastructure remains under a cloud though, maybe, this is showing a few signs of improvement.

*Duration represents the number of ‘periods’ that it will take to repay an initial investment in a fixed interest security. It is not the same as the life of the bond or time to maturity, which will be longer. It can also be viewed as a measure of the sensitivity of the price of a bond to a change in interest rates.

**Redemption Yield represents the total return expected from the bond(s) taking into account interest received and capital gain as the bond(s) move to ‘par value’ (100p) at maturity. The ‘Running Yield’ shown is the current expected annual income for the whole portfolio, as a percentage.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?