Our multi-asset commentary for September was written in the immediate aftermath of Kwasi Kwarteng’s mini budget, or ‘Growth Plan’ as it was labelled at the time.

As has been well documented, the UK Gilt market slumped in the days following, ratcheting yields up along the curve: two and ten-year yields hit 4.5% and the thirty-year hit 5%, levels not seen since before the GFC.

The worst of the drama occurred at the long end of the index-linked Gilt market, not the most liquid at the best of times. Most incredible being the fall in the longest of these issues, Treasury 0.125% 2073, which, by 27 September, had fallen an almost unbelievable 90% since last November. In turn, this triggered problems for the pensions industry and Liability Driven Investment (LDI) policies and the Bank of England had to step in to restore order to the markets. (For an explanation of what happened in LDI please listen to Jeremy Wharton’s explanation in our Tenax Webinar of 25 October).

Having been critical of the Bank of England’s actions over the past couple of years, we should acknowledge that they have managed this difficult period well. The timing and manner of their intervention was well-judged along with the clear cut-off date for support.

The sacrifice of Kwasi Kwarteng, his replacement by Jeremy Hunt, resignation of Liz Truss and establishment of Rishi Sunak as the new Prime Minister was farcical at times. But, hopefully, we do now have an administration that understands the need for measured steps and some confidence in the outlook for public finances. The recovery in sterling (up by around 11% from late-September lows) indicates that the initial actions are encouraging.

It was interesting to see quite how much the mayhem in UK rates markets infected other markets, though their moves were not as aggressive. UK rates have now dropped back below US rates again, having exceeded them by 50bps during this period, the UK ten-year is now at 3.65% and the thirty-year at 3.75%. The Bank of England’s MPC meets again next week, we expect a further increase in the Base Rate of 75bp to 3%, expectations of the ‘terminal rate’ are now being scaled-back.

We also expect the ECB and the US Federal Reserve to lift their rates by 75bp shortly. German ten-year yields reached 2.4% before drifting back to where they were at the end of September, the US ten-year reached 4.25% and is currently around 4.1% awaiting more inflation data. The European economy is in recession already, the US is slowing (notably housing). The Chinese economy does not look at all encouraging with on-going problems in their property market and COVID restrictions leading to a rapid slowdown.

Faced with all the uncertainty the major equity markets have begun to rally, the S&P 500 has gained around 6% over this period and the European markets by around 8%. There was simply too much gloom out there. London stocks have begun to pick-up, notably in the mid-cap area, the FTSE 100 is as distorted as ever and unchanged over the period. Tech stocks have also recovered, but ‘disappointing’ results from Alphabet and Microsoft overnight may temper this. In common with many US companies, the tech giants are citing problems with the strength of the US dollar.

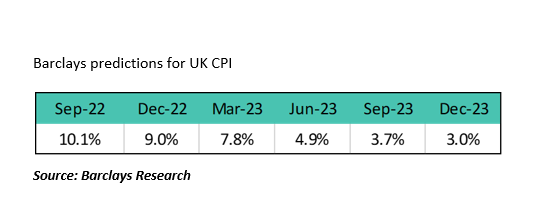

As we keep repeating, it is still all about inflation. We expect price increases to moderate over 2023 and must repeat that inflation is a lagging indicator. We note that European gas prices are now around 70% lower than their August peak while freight rates have been sinking all year. Here are Barclays predictions for UK CPI over the year ahead (above, right).

To repeat ourselves, we consider that markets (fixed interest and equity) have ‘priced-in’ a lot of bad news at this stage. Of course, we recognise the degree of uncertainty in a number of areas but also consider that the returns on offer now, notably in the sterling credit markets (particularly at the short end), should not be ignored.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?