Two months into 2024 and stock markets have, once again, been dominated by the performance of the NASDAQ and, more specifically, by the ‘Magnificent Seven’ and current poster child Nvidia, which reported another set of record-breaking results.

The NASDAQ has gained more than 8%, fuelling an increase of 7.7% for the S&P 500. Japan has also continued its run with a further gain of 14% for the Topix, London and Hong Kong are the laggards, showing small negatives for the year to date. And this despite some nasty geo-politics, difficult domestic politics for the US and UK (et al) and a much more difficult period for bond markets as central banks sought to cool talk of imminent rate cuts.

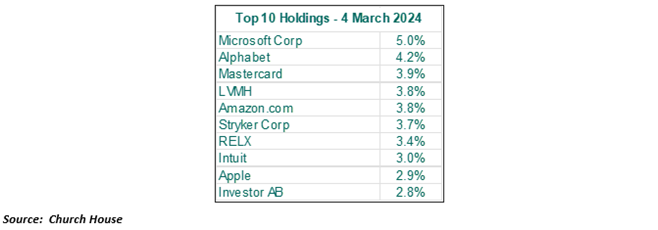

The Esk Global Equity Fund has had a positive period. The top ten holdings will be familiar, the only change in this list being a small reduction in the Microsoft holding in January, taking the weighting back down to 5% after the stock hit new all-time highs. Microsoft remains as our favoured long-term holding in the area, but the NASDAQ is vulnerable to a set-back after the strength of recent moves. Slipped from this list recently are Johnson & Johnson and L’Oreal reflecting a comparatively dull period for pharmaceuticals and staple goods companies. Replacing them in the pecking order are the Swedish holding company, Investor AB and Intuit.

Investor AB, which, incidentally, has been in the Fund’s portfolio since 2008, is benefitting from its major long-term holdings in Atlas Copco and ABB, while Intuit has recovered from its lurch in 2022 and is increasingly being viewed as a beneficiary of AI. Apple is under some pressure, they have fallen nearly 10% over the year so far, the market clearly thinks that they have a lot to prove amid concerns over weak demand for its key products and more problems with European regulators, we reduced our weighting in November and will stay with this lower weight for now. Ansys jumped in late December and an agreed bid for the company from Synopsys was announced at the beginning of January. This bid is part cash and part new stock in Synopsys, Ansys share price remains at a discount to the value of the bid, we are watching developments.

The other pharmaceutical and healthcare holdings in the portfolio saw contrasting fortunes. Stryker has powered ahead again and the new holding in Cencora (formerly AmerisourceBergen) has had a good year while the Swiss group, Lonza has largely recovered a poor final quarter to 2023. In contrast, the new holding in UnitedHealth Group has fallen after the US Department of Justice initiated an antitrust investigation into their purchases of healthcare companies. The Japanese holdings were, unsurprisingly, a strong feature, notably the financials, which saw good gains for Sumitomo Mitsui Financial and particularly for Nomura, which gained around 38%. Sony Group was the only detractor, they have fallen around 3%, after flagging weakness in their gaming business and reduced forecasts for PlayStation 5 sales. The luxury goods companies bounced back sharply after the poor second half of 2023, LVMH (Louis Vuitton etc.) gained 14% and Hermès 19% after reassuringly strong figures, both outshone by a 25% for Ferrari.

Most of the activity in the Fund’s portfolio was centred around drinks companies. The spirits companies were spooked by a warning on sales from Diageo, which reverberated around the sector. In common with most of the European spirits companies, Rémy Cointreau was knocked back and we added significantly to this holding in late January, feeling that the fall had been overdone. Heineken produced more rather lacklustre figures and, though we still have regard for this company, it is hard to get enthused about their prospects, we have sold the holding in favour of commencing a new position in Coca-Cola. Coke produced more good figures in February but, after an initial flurry, these have largely been ignored. The quality and consistency of this company is outstanding and their current rating is a fair price to initiate, they have an on-going dispute with the IRS, which must account for some of the current pricing, we are pleased to have made a start in building a holding.

*****************************************

Esk Objective and Policy:

• Long-term capital growth

• From an international equity portfolio

• Actively Managed portfolio of 40/50 holdings

• Strong bias to quality and growth

• Aim to buy-and-hold for the long-term

• Aware of ‘benchmarks’ – does not track them

• Developed markets only (rule of law)

A few things Esk does not do:

• No emerging markets investments

• No smaller companies

• No unquoted companies

• No ‘un-profitable tech’

• No shorting

• No ‘regional’ banks

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?