Dynamic Planner: introducing Tenax Absolute Return Strategies Fund

James Mahon, co-manager of the Tenax Absolute Return Strategies Fund, speaks to Dynamic Planner about the inception of Tenax and its use as a decumulation vehicle.

With assets under management in excess of £1 billion, Church House Investment Management is a fund and portfolio manager offering specialist services to individuals, financial professionals and institutions for over 20 years.

The content you are trying to view is aimed at Professional Investors. To view please confirm:

Registered in England and Wales No. 03475556 Investors should be aware that past performance is not a reliable indicator of future results and that the price of shares and other investments, and the income derived from them, may fall as well as rise and the amount realised may be less than the original sum invested. Church House Investments Limited is authorised and regulated by the Financial Conduct Authority

Finding a balance between sustainable withdrawals and capital preservation

James Mahon, co-manager of the Tenax Absolute Return Strategies Fund, speaks to Dynamic Planner about the inception of Tenax and its use as a decumulation vehicle.

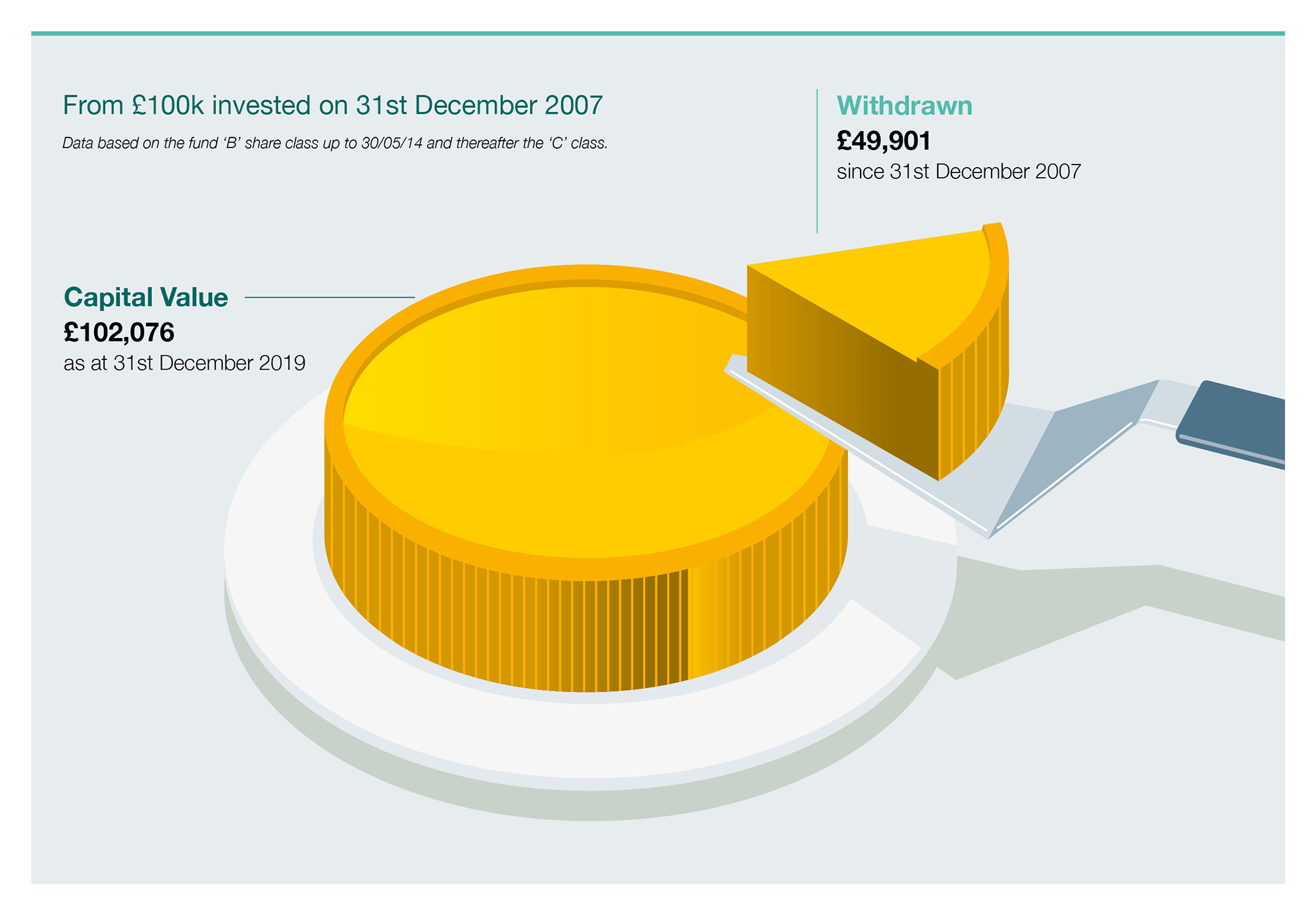

Since launch in 2007, Tenax has proved that even through the toughest of times, it can work as a suitable investment strategy for investors in retirement. It offers investors who choose drawdown as an alternative to an annuity purchase the potential to take withdrawals while maintaining or even growing the value of their capital.

The low volatility of returns creates a low sequence of returns risk, an attribute which has been identified by Dynamic Planner in their search for funds suitable for their Risk Managed Decumulation Service.

Tenax was included in initiative to help advisers compare decumulation investment solutions.

On 3rd April 2020, Dynamic Planner launched its Risk Managed Decumulation Ratings, initially awarded to just eleven funds that met the selection criteria, the Tenax Fund being one of those. Funds awarded a rating should have low sequence of returns risk, such that the timing of withdrawals from a retirement account will have little impact on the overall rate of return available to an investor

Tenax included in initiative to help advisers compare decumulation investment solutions.

On 3rd April 2020, Dynamic Planner launched its Risk Solution certificate, initially awarded to just eleven funds that met the selection criteria, the Tenax Fund being one of those. Funds awarded a rating should have low sequence of returns risk, such that the timing of withdrawals from a retirement account will have little impact on the overall rate of return available to an investor

Intermediary Sales

Intermediary Sales

Site by 999 Design