We have just returned from an uplifting trip around Britain and Northern Ireland, speaking to current and potential investors in our funds.

After a year during which people seemed to avoid in person meetings in favour of Zoom, it was refreshing to once again be discussing the markets face-to-face. The trip made for much more interesting conversation and we got to hear what investors across the country were really thinking.

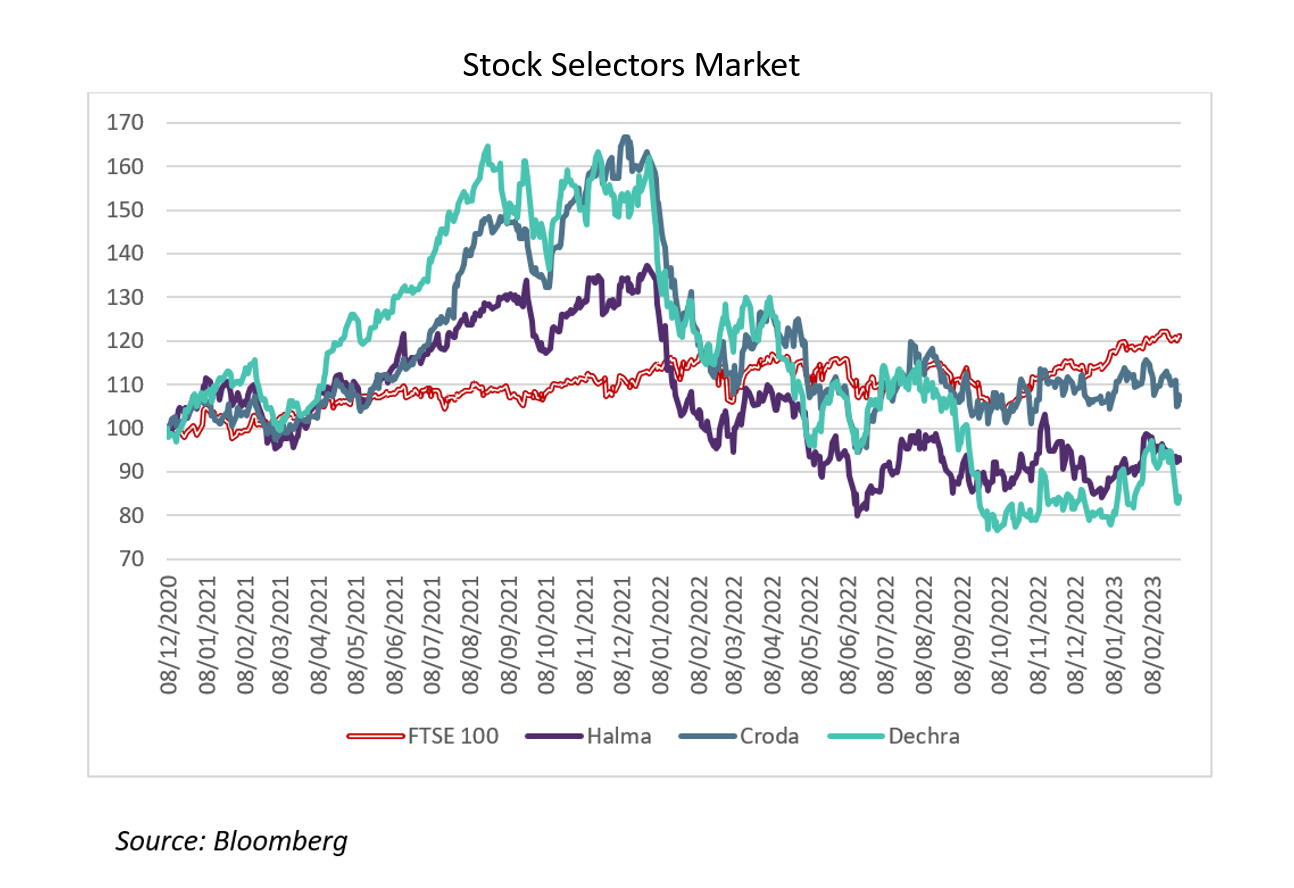

During each meeting we discussed UK markets and it was notable that there is a growing undercurrent of enterprising investors who sensed opportunities in our beaten-up home market. True, there is no hiding from the own-goal that is Brexit and how far Britain has lagged behind other nations since 2016, but there comes a point where universal pessimism opens up to opportunity for those brave enough to back their contrarian instincts. From a stock picker’s perspective, the sell-off in quality growth names during 2022 has left the shares of multiple exceptional London-listed businesses trading on their lowest multiples for years, decades in some cases.

So what is the catalyst for a turnaround? Why the U.K. and why now? This is the recurring pushback that we found during our presentations, as investors tired of UK underperformance continue to reduce their exposure. I cannot pretend to know what this catalyst is or when it might come, but I can tell you that it will be too late once it has arrived. Did it feel like the bottom of the market in March 2020 when we were all locked up at home or in 2018, the year when virtually all asset classes were in the red? At the time it certainly did not to me and a catalyst for change was similarly elusive.

Taking a step back from the universal doom-and-gloom surrounding UK macro allows one to focus instead on the quality businesses that are available to investors in the UK and that continue to grow profitably in the face of all of this and in-spite of all this. What can you do today that your clients will thank you for in five years time? How about showing conviction and being one of the first to buy back into the UK.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?