Uncertainty is rife with the ongoing spread of coronavirus outside of China and markets hate uncertainty.

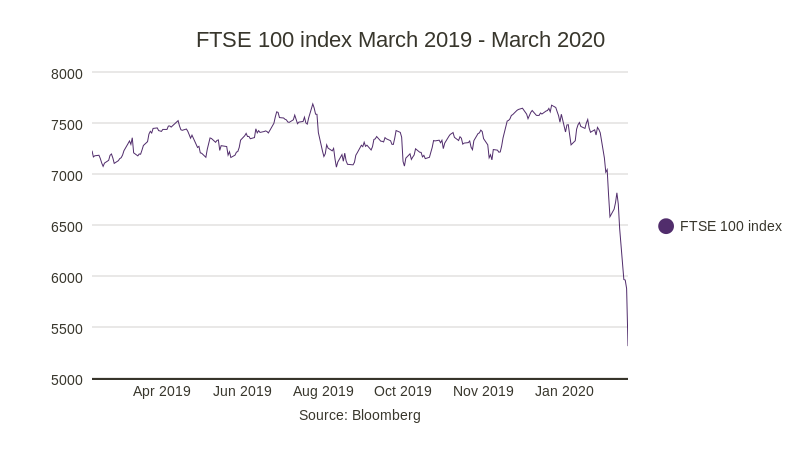

After a serene few months for UK markets, the Boris bounce was over in a flash and the FTSE plunged to levels last seen in the wake of the Brexit referendum in 2016.

In the context of this market setback, it is an appropriate moment to remember Warren Buffett’s advice that we should be; “fearful when others are greedy and greedy when others are fearful” – i.e. times of widespread market sell-offs and peak uncertainty tend to present great opportunities.

We have had a busy few weeks on the Church House UK Equity Growth Fund buying up what we believe are oversold UK equities. We have been putting cash to work adding to core investments such as Compass Group, Croda, Halma, Spirax-Sarco, RELX, Diageo … the list goes on.

We have also been lucky enough to have the opportunity to add two new positions to the Fund – Experian and L’Oréal (not strictly a UK equity we realise but we are allowed some flexibility here). These are two exceptional businesses that we had wanted to own for a number of years but never felt that the valuation was low enough to warrant an attractive entry point.

The market dislocation caused by coronavirus has been relatively indiscriminate, sending shares in businesses both good and bad lower – hence we were able to begin building positions in Experian and L’Oréal at what we see as sensible prices.

We still have some cash resources in the Fund and look forward to seeing further opportunities. As Simon Peckham, CEO of Melrose Plc (one of our investments) reminded us at their annual results last week; “Don’t waste a crisis”.

How would you like to share this?