Global equities surge—see what’s driving the momentum and why it matters.

What US Government shutdown? There was a time when investors worried about US budget standoffs (now the second longest in history), but this is not it. Global markets continue to march triumphantly higher, led by the might of Silicon Valley. We are in the midst of third-quarter earnings season, and overall, the Magnificent Seven managed to deliver strong enough results to uphold their high valuations and, in the case of Amazon, Apple and Alphabet, provide the catalyst for shares to hit new highs. Meta was the one exception, having its worst share price day in three years as Mr Zuckerberg flagged rising expenses and slower margin growth next year.

US tech may be getting most of the headlines, but we have seen high equity returns across the globe. To pick a few of the major indices year-to-date price returns to the end of October:

FTSE 100: +18.9%

S&P 500 +16.3%

Dax: +20.3%

Nikkei 225: +31.4%

Shanghai Composite: +18.0%

(source: Bloomberg)

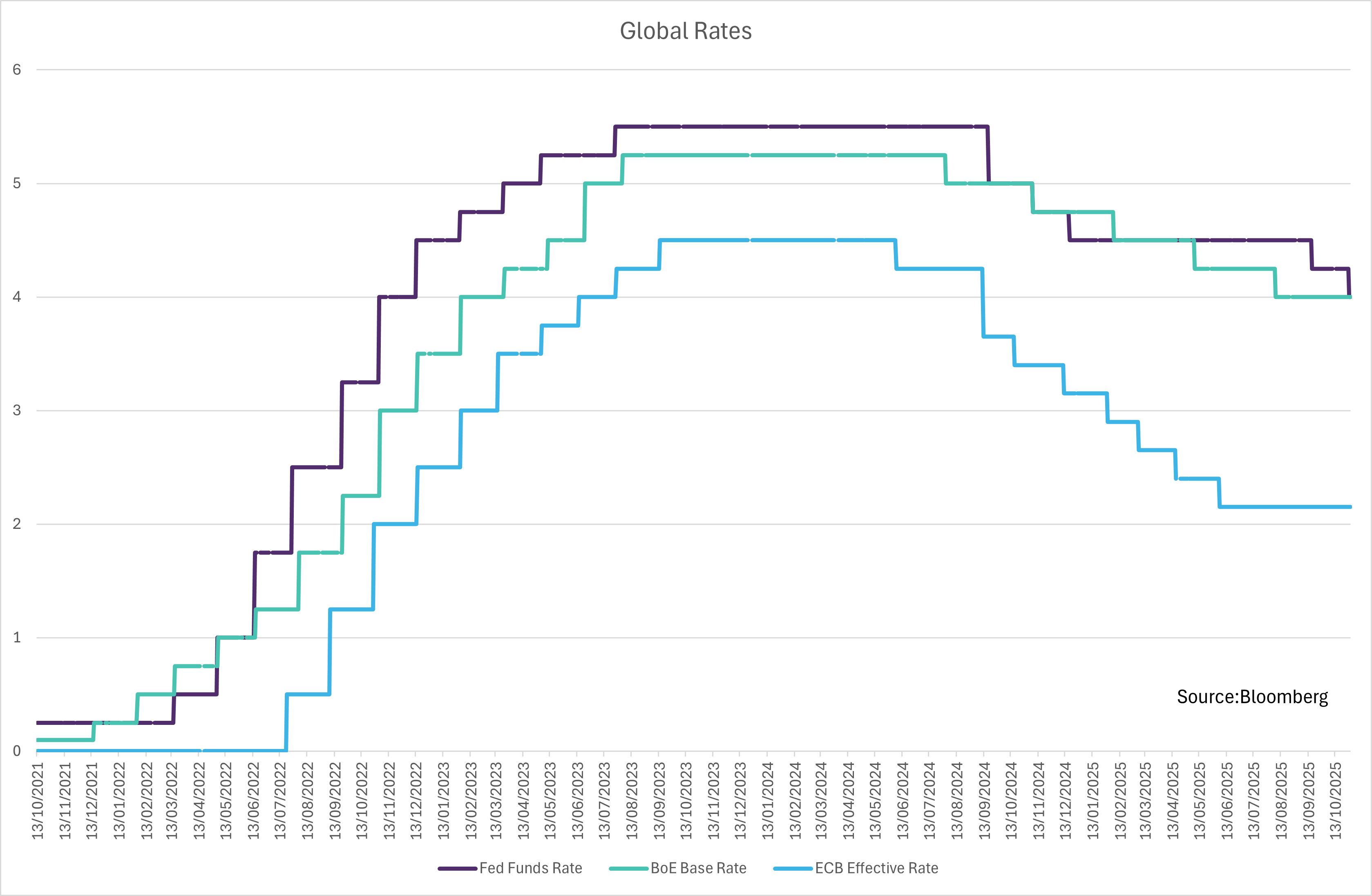

The proverbial dart throwing monkey would likely be having a good year. One can point to AI and all the potential for growth it holds as being behind high returns, but do not forget that we are going through a global rate cutting cycle at the same time as the AI “revolution” and this floods markets with liquidity. The adage, Don’t Fight the Fed comes to mind. See the chart across.

The rising tide has not floated all boats and there are still unloved corners of the globe that investors continue to spurn in favour of momentum elsewhere – just ask UK mid and small cap managers. It feels like there will come a point when the current market momentum will snap back and that there are plenty of crowded trades out there, but it has been a tough market to miss out on. To repeat the quotation that we used in our recent Quarterly Report to private clients. Here Warren Buffett is in his letter to Berkshire Hathaway shareholders in 2000:

Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behaviour akin to that of Cinderella at the ball. They know that overstaying the festivities – that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future – will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There’s a problem though: They are dancing in a room in which the clocks have no hands.

Berkshire Hathaway Inc., letter to shareholders 2000

Important Information

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note that the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?