Active managers and monkeys in the doghouse.

Christmas party season during bull markets is the stuff of legend. For example, my first office party (at an institution that shall remain nameless) was a black-tie dinner and dancing at Claridge’s – fancy! But this year does not feel like boom time in London, despite the FTSE 100 up 18.9% over the 11 months to date and all the global indices rising in the double-digits.

Where are the popping Champagne corks you ask?

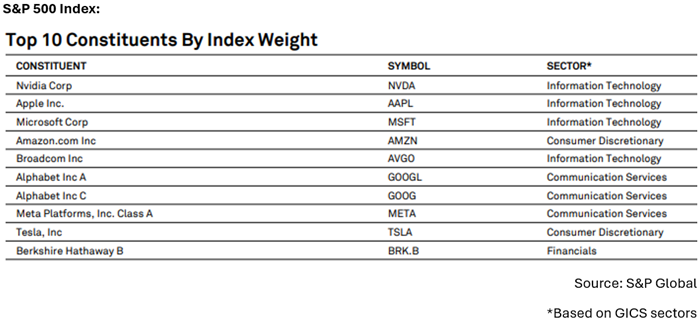

One of the reasons that the investment industry is keeping its head down (Church House are heading to a gastro pub in Marylebone) is that this has been a very “narrow” market where a handful of mega cap stocks (the Magnificent Seven) have generated the majority of returns and as an industry, active managers have been underweight these names. The old argument that a monkey throwing darts as the FT back pages to pick stocks could perform as well as the average of all active managers would seem to hold.

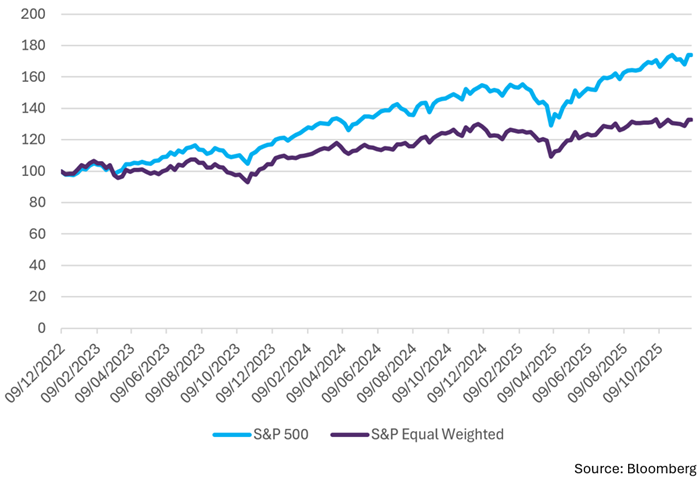

However, the proverbial monkey would also have had a tough year in 2025. To simulate this, we can compare the S&P 500 Index (which is weighted by size of company – e.g. Nvidia is the largest constituent at 7.2%) to the S&P 500 Equal Weighted Index, where all 500 companies have the same weight. The monkey would be more likely to own the equal weighted index given that their dart stands the same chance of landing on any stock. In 2025, the S&P 500 is up 16.5% to date but the equally weighted index has returned only 9.0%. If this is stretched out over three years the outperformance of large companies (the S&P 500) is astonishing (see chart, right).

Over three years monkeys are certainly no better (and possibly worse) than active managers. Has this always been the case? No.

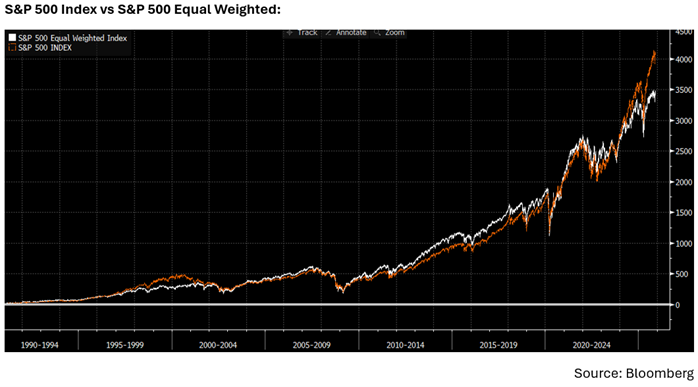

During the 35 years since the S&P 500 Equal Weighted Index was created there is next to nothing to choose between that and the regular S&P 500. There have been periods when large caps have outperformed (e.g. the mid-1990s until the dot.com buttle burst or now) and periods when mid and small caps have had their day in the sun (e.g. the five-year periods post-dot.com and post-Financial Crisis).

So why has the trend changed since 2022? Are we witnessing the beginning of a new normal or are we due a pullback in mega caps?

Reversion to the mean is hard to dispute on the basis of the 25-year chart. We currently see the widest positive diversion in performance of large caps relative to the wider market since dot.com – fuel for those calling an AI bubble in mega caps.

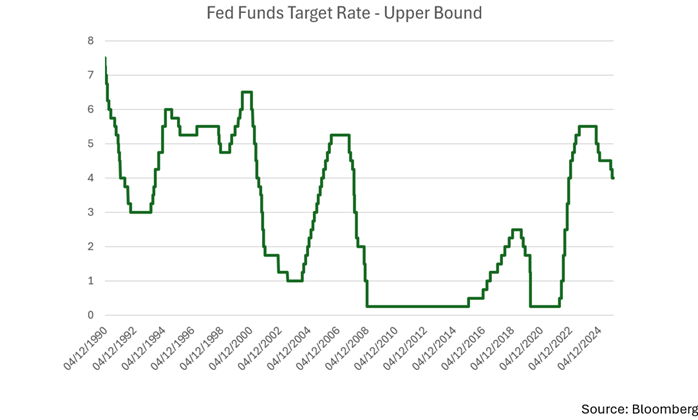

But there is far more to the picture than this one chart. The interest rate factor cannot be ignored when it comes to the performance of small and medium sized businesses. The two highlighted periods of small company outperformance also coincide with the Federal Reserve cutting rates sharply and (in the case of 2008 to 2016) rates staying close to zero. Dovish central banks allow more businesses access to cheap capital, hence strong period for the Equal Weighted Index.

So far, lower rates in the current cycle since peaking in summer 2024 have not resulted in a pickup in performance for the wider market, in fact we have seen the Magnificent 7 extend their lead. One reason why markets have behaved differently this time around (to date) is that the market leaders (tech stocks) are delivering phenomenal results on any metric one likes to look at – yes, there is jam tomorrow in the AI story but there is plenty of jam today also – just look at now much cash these giants are all making. Another reason why animal spirits have not extended more widely is that businesses and consumers are all somewhat terrified – one only has to turn on the news to be fed a tirade of bad news. Is it any wonder that spending has not stepped-up despite lower rates? No.

It is not just monkeys and underperforming fund managers that are looking to discredit the strength of tech stocks and calling for an AI bubble – from the Bank of England to Michael Burry, there are plenty of naysayers. We own four of the Magnificent 7 in our Esk Global Equity Fund and continue to view these as excellent businesses that we expect to be mainstays of the Fund for years to come. What we would say and, how we have positioned Esk, is that we expect to see a broadening of the market in the year ahead as interest rates continue to come down and two mid-term governments on either side of the Atlantic, on balance, throw fewer curve-balls into the mix than they have down in the last year as Trump and Starmer have to realise that they are not helping their economies and so themselves by doing so. Reversion to the mean is one thing but never underestimate the power of money (interest rates) and animal spirits.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note that the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?