Fred Mahon shares an update on activity in our Esk Global Equity fund.

Against the backdrop of roaring markets and a busy Q3 earnings season, the portfolio remained largely unchanged over October. We added to our position in Straumann, the global leader in dental implants. Straumann is an exceptional business, with a net cash position and margins that most CEOs would kill for. Despite this, shares have been out of favour in recent years as US consumers have felt the pinch and cut back spending on their winning smiles. Ahead of their recent earnings release, we felt that the sell-off was overdone and added to our position – shares duly obliged with a nice rebound on results.

We were made to look less clever by Alphabet the following day. Alphabet is our largest position in Esk, with the share price having tripled in less than three years. We felt that with shares up 100% since their 2025 lows made in April it would be prudent to take profits and trim our holding. Bet against the tech bull market at your peril – shares are up 11% since then.

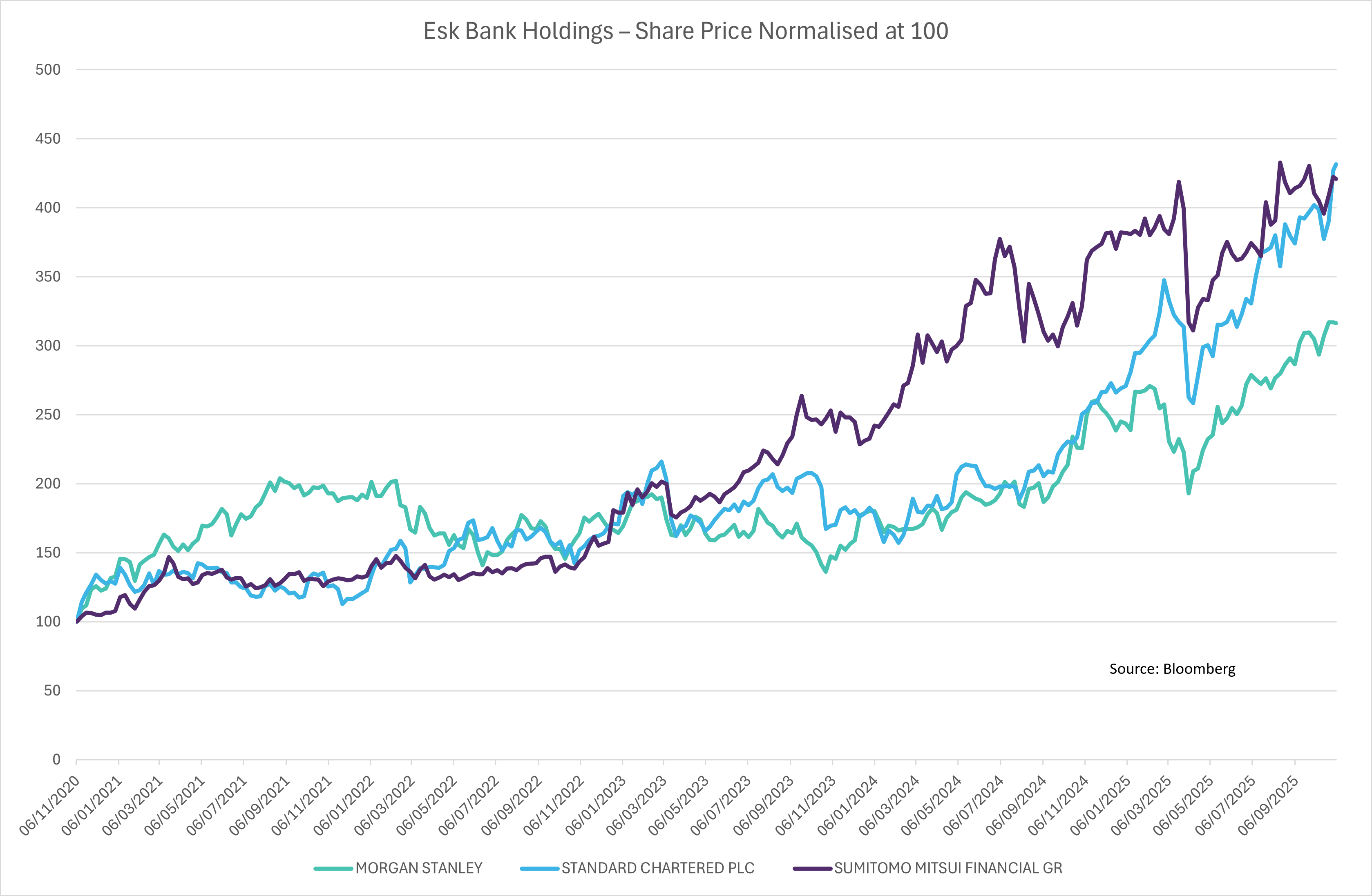

In addition to Alphabet, all our US mega-cap tech stocks continue to power ahead – Microsoft, Apple and Amazon are all at (or close to) all time highs. This is a momentum driven market and the same has been the case for our bank holdings, from Standard Chartered, to Sumitomo Mitsui, to Morgan Stanley, the steady march higher of their share prices has been remarkable. If one had told an investor back in the decade leading to 2020 that banks would be so in vogue, you would have been laughed out the door. See the chart across.

Outside of tech and banks, we were also encouraged to see LVMH and Nestle shares pop (higher) on results. We had added to both positions on weakness, but shares are still well below previous highs – plenty of scope for upside although patience will likely be required.

While LVMH helped our luxury positions, Ferrari failed to wow at their recent investor day, in fact shares fell on news that they have scaled back electrification targets, now expecting only 20% of its cars to be fully electric by 2030, down from a previously stated 40% target. In our opinion this is not necessarily bad news for Ferrari and that buyers of their cars do not have electrification high on their list of priorities. We are monitoring the position for opportunities to add if there proves to be further weakness.

Our holding in Novo Nordisk has proven to be very noisy since we initiated in spring 2025. Our conviction is that there is value here and that the market is being overly bearish about their prospects in both diabetes and obesity care. Nonetheless, our patience is not infinite, and we will continue to monitor the situation closely.

Important Information

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note that the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?